Please watch the video below for our new health coverage plan explanations; once you are ready to complete the form it’s available at the bottom of this page to complete digitally and submit. If you have any questions please email admin@adcockbros.com your questions and Greg/Ryan will make sure we get them answered.

Please note this MUST be completed by Thursday as your existing health coverage will expire at the end of this week.

Your insurance program is changing for the better…

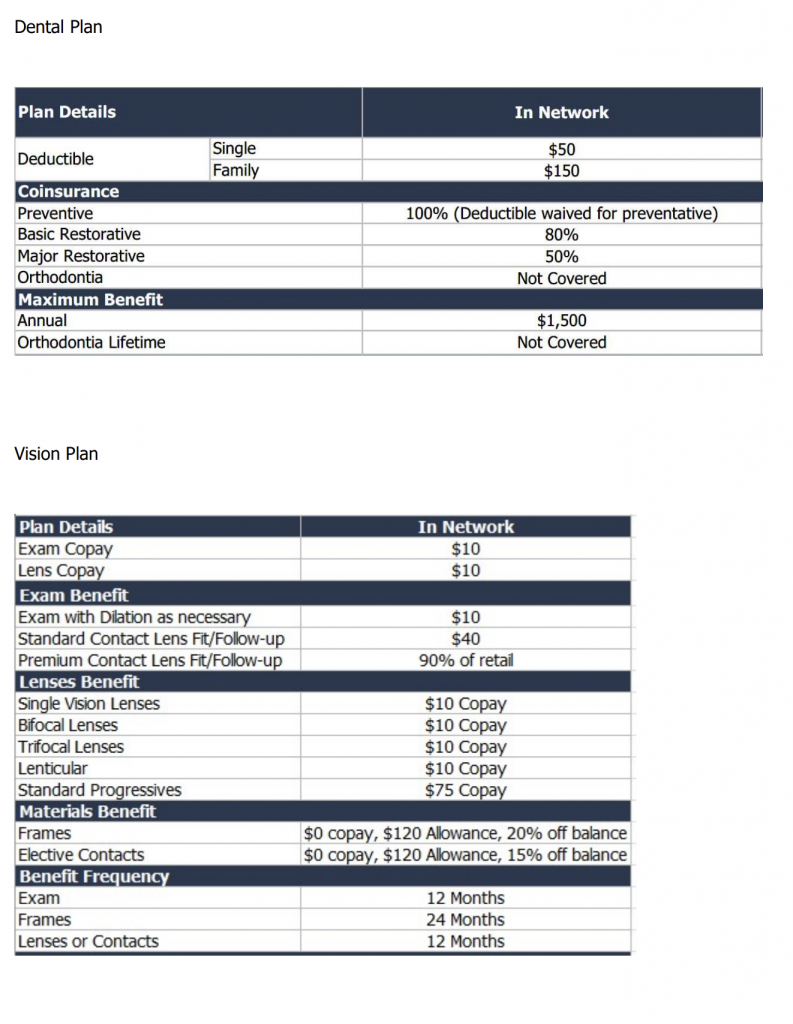

Adcock Brothers health, dental and vision insurance programs are moving to Aetna Health effective August 1, 2022.

With this change, you will see similar plan designs, along with improvements to your monthly premium. You will also be offered added Claim Counselor services at no additional cost to you. Any accumulated deductibles will rollover from Capital Blue to Aetna.

You still have access to the same great network of doctors, providers, and hospitals.

Claim Counselors is a new service available to you. If you have questions on any of the following:

- Investigate claims payment and/or eligibility accuracy when in question

- Act as an intermediary between employee and insurance company or administrator as needed

- Help employees become better health-care consumers

- Deductibles

- Co-payments

- Coinsurance

- Out of pocket maximums

- Claims filing requirements

- Extensions of benefits

- Flexible Spending

- Exclusions

- Limitations

- Coordination of Benefits (COB)

- Requests for information

- Appeals process

- Eligibility

- HRA/HSA concepts

Claim Counselors will get your answer. When you call, a real person will answer the phone and provide you with accurate information in real time.

Remember to fill any Prescriptions before August 1st to ensure you are not without required medications prior to receiving Aetna ID cards.

2022/2023 PLAN OPTION INFORMATION

We are offering 2 plan options moving forward one Traditional Plan and one HSA (Health Savings) Plan. Please review the information and then click on the link at the bottom of the page to complete the enrollment form.

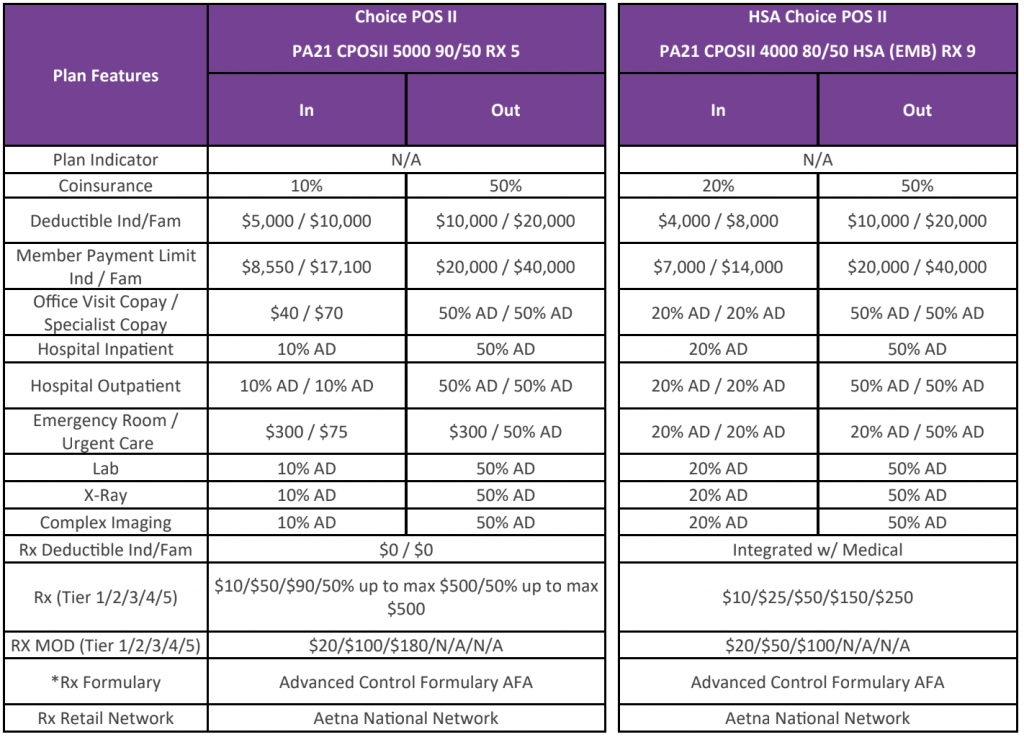

5000 Traditional / 4000 HSA* Plan Comparison

*4000 HSA (Health Savings) Plan selection, includes 100% Paid Employee Coverage, $10 per week employers contribution to your HSA account.

Tier 1 Rx is going to be generic, Tier 2 is Preferred,

Tier 3 is Non-Preferred, and Tier 4 is specialty.

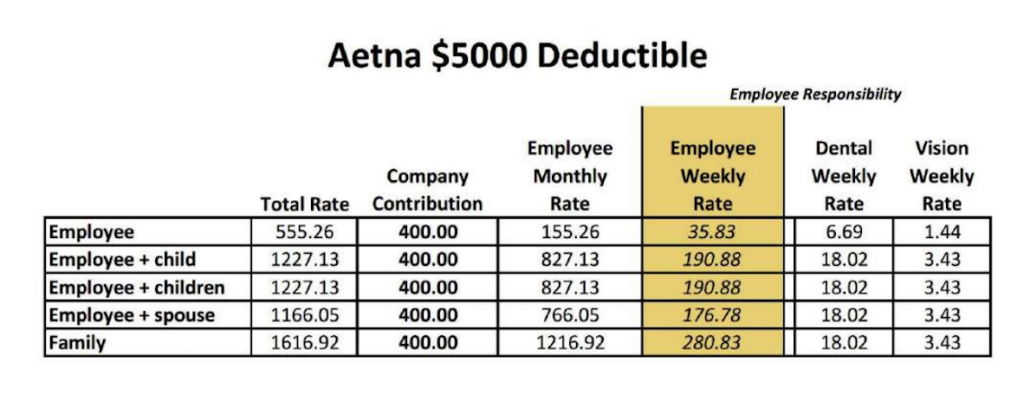

5000 Traditional Plan Costs

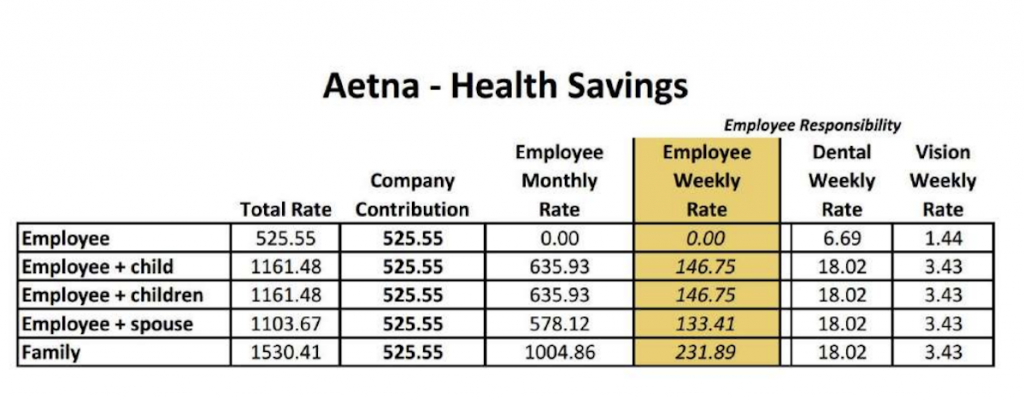

4000 HSA* Plan Costs

*4000 HSA (Health Savings) Plan selection, includes 100% Paid Employee Coverage, $10 per week employers contribution to your HSA account. The funds put into the HSAPre-Tax and balance will roll-over when not used during the year.

You are allowed to use your HSA account balance to pay any health related expenses throughout the year, tax-free. For 2022 you are allowed to add up to $3,650 for self-only and $7,300 for families in your HSA account tax-free to reduce the income you pay taxes on, and store that money for paying out health related expenses when needed.

Useful Links

Complete Enrollment

All Employees Opting in/out of insurance plan are required to complete the below form.

If you choose to OPT OUT of coverages simply fill out your personal information on page 1 and select the opt out at the bottom of page one and sign and submit.

If you are accepting coverage DO NOT sign on page one, just complete the entire form and sign on the last page of the form.